Exness Leverage in India

Trading CFD involves risks

Exness leverage ✓When trading forex you can use various tools that help in achieving your goal, one of the most important is leverage. In this article, you can learn what Exness leverage is, its purpose, its proper use and choosing the size for optimal trading.

Article updated:

21.05.2024What is leverage Exness?

You must be wondering what leverage means. It is similar to a loan that a broker offers to a trader. Leverage allows people to make large trades even if they don’t have a large deposit. As a result, it increases the purchasing power of traders.

In other words, Leverage gives traders the opportunity to utilize a large amount of funds even if there is only a fraction of the amount needed in the account. The purchasing power of traders is highlighted by the ratio between the ratios:

- Trader’s funds

- Borrowed funds

For example, this ratio can be 1:200, 1:2000 or 1: Unlimited.

The maximum amount of leverage that can be used by traders when trading currency pairs depends on the leverage rules, as well as the trading terminal and account type.

The amount of leverage depends on factors based on the account balance.

How does exnes leverage work?

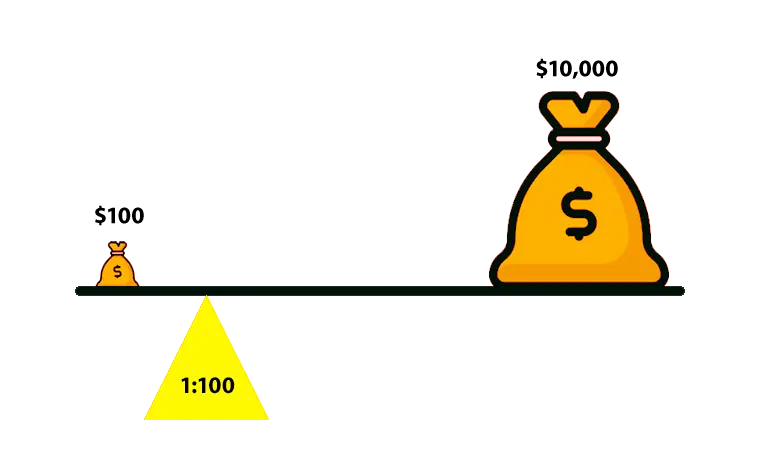

Simply put, leverage can be thought of as borrowing money from a broker to increase the size of your trading position. This allows you to make trades for amounts that are significantly higher than your current funds. For example, if you have $100 in your account and use 1:100 leverage, you will be able to control a $10,000 position.

Trading CFD involves risks

Set 1:100 leverage exnessAn example of how exness leverage works

To understand how leverage works in Exness we need to look at a specific example:

A trader has an initial capital: 100 dollars

He sets leverage: 1:100

Controlled amount: 100 dollars * 100 (leverage) = 10 000 dollars.

If the market moves in his favor and the price of the asset increases by 1%, and his profit will be 1% of $10,000, that is $100. This doubles his initial capital.

However, if the market moves against him and the price of the asset decreases by 1%, his losses will also be $100, resulting in a total loss of his capital.

Example of using leverage in real trading

Trader 1:

Initial capital: $500

Leverage: 1:50

Controlled amount: 500 dollars * 50 = 25 000 dollars.

Result: The market moves in favor of the trader, the asset grows by 2%. Profit: 25 000 dollars * 2% = 500 dollars. In the end, the capital doubles to $1,000 from the initial $500.

Trader 2:

Initial capital: $1,000

Leverage: 1:100

Controlled amount: 1000 dollars * 100 = 100 000 dollars.

Result: The market moves in favor of the trader, the asset grows by 1%. Profit: 100 000 dollars * 1% = 1000 dollars. In the end, the capital increases to $2,000.

Trading CFD involves risks

Use Exness leverageWhy leverage Exness?

Leverage allows any trader to greatly increase their trading opportunities and flexibility in strategies. Proper understanding of leverage and its application is important when using it.

With limited capital, the use of Exness leverage allows you to apply large volume trades – this can be useful for beginner traders. It is also an opportunity to test strategies in real trading and get more significant results from it.

Examples of increasing trading potential:

- Beginning trader:

He has only $200. Using 1:50 leverage, he can control a $10,000 position. This allows him to test his trading strategies with more capital and increases his opportunities. - Experienced trader:

With a capital of $5,000 and using leverage of 1:100, he can trade $500,000, which greatly increases his opportunities and testing of complex trading strategies.

Using leverage exness in trading

To use leverage in Exness, you need to understand the underlying strategy and be careful. There are some important tips for proper utilization of this tool:

- Smaller item sizes

To minimize risks and gain experience – when starting trading it is advisable to use the minimum amount of leverage to understand how it affects transactions - Use stop loss

Set a stop loss to limit potential losses in case of unfavorable market movements (if you opened a $10,000 position with leverage, setting a stop loss at 2% loss will help you preserve capital). - Market monitoring

Constant monitoring of positions with possible adjustments to your strategy. Regular monitoring of news and quotes will allow you to react in time to possible risks and adjust your trading strategy.

Popular strategies that use leverage:

- Scalping

A type of trading that involves many small trades within a short period of time. And using high leverage allows you to make quick but small profits. - Day trading

As the name implies, the essence of the strategy is to trade during one trading day, and the use of leverage is used to increase the volume of trades. - Swing trading

The essence of the strategy is to hold positions for a few days to a few weeks, using medium sized leverage to balance risk and profit potential.

Trading CFD involves risks

Exness leverage in tradingThese tips provide insight into how leverage is used by traders to achieve trading goals. This tool can greatly increase your opportunities in various strategies.

Advantages and disadvantages of leverage

Exness leverage has a number of advantages that provide opportunities for traders, but also leverage has certain disadvantages.

Advantages leverage Exness

Increasing profits

The main and foremost advantage is the ability to increase potential profits. For example, using leverage of 1:150 with a balance of 20 dollars, a trader can control a position of 3,000 dollars, and with positive market dynamics (in favor of the trader), the positive opportunities increase

Flexibility

Leverage in Exness is the ability to trade large volumes with a small amount of money. This is used in various strategies such as day trading, swing trading and scalping. Adapt your own strategies to market conditions using leverage

Affordability

The ability to enter trading with minimal finances. This allows more traders, including beginners, to use forex – starting with a small capital and gradually increasing it using leverage to increase the volume of transactions

Disadvantages leverage Exness

High risks

If the market moves negatively, losses can result in loss of initial capital. For example, using 1:100 leverage using $100, a 1% drop in the price of an asset can result in a complete loss of initial capital. But this can be prevented by using a stop loss tool

Complexity of management

To use leverage, you should carefully monitor your positions for trades and consider the possible risks. You should be prepared for rapid market changes, as poorly controlled positions can lead to financial losses and therefore it is important to have a good plan

Psychological pressure

Using high leverage can lead to emotional decisions. Deals with high levels of leverage can cause uncertainty or overconfidence which can have a negative impact on results. You should remain calm and follow your trading strategy, avoiding impulsive decisions

Exness leverage offers much more trading potential and increased flexibility, but due to the risks involved, a responsible approach and risk management is required.

Trading CFD involves risks

Get benefits Exness leverageHow to use leverage correctly

According to experienced traders, proper use of Exness leverage requires adherence to various practices. This section reviews key guidelines and breaks down examples of both successful and unsuccessful use of leverage.

- Training

Before you start using leverage, it is important to understand how it works and what results it can bring, for this you can get training, read articles, watch training videos and attend courses. Learning the mechanics of leverage in Exness is an important factor in successful trading - Practice

In order to understand how leverage in Exness works, it is important to practice on demo accounts in order to gain experience without risking your finances. It’s worth starting with an Exness demo account to test your strategies, understand how Exness leverage affects your trades and learn how to manage risk

You need to use various tools to manage risk:

- Stop Losses

Set to limit losses – automatic orders that will close your position when a certain level of loss is reached - Limit orders

Help you lock in profits by closing your position when the desired price level is reached - Leverage size

Start with a small amount of leverage and gradually increase it as you gain experience and confidence - Diversification

Do not invest all your capital in one trade or asset. Spreading your capital across different trades and assets will help reduce your overall risk and protect your capital

Examples of successful leverage

Example 1: What a successful trader does

Training: Took courses on leveraged trading and learned all the risks.

Practice: Started with a demo account and tested my strategies for several months.

Risk Control: Used stop losses and limit orders to manage risk.

Diversification: Allocated capital between currency pairs, stocks and commodities.

Result: The trader was able to steadily increase his capital while minimizing risk and controlling losses.

Example 2: What an unsuccessful trader does

Training: Limited himself to minimal knowledge of leverage.

Practice: Immediately started trading on a real account without testing strategies on a demo account.

Risk control: I did not use stop-losses and limit orders.

Diversification: I invested all funds in one trade.

Result: Due to lack of experience and lack of risk control, the trader quickly lost his capital when faced with unfavorable market movements.

How to choose Exness leverage level

A proper assessment of trading opportunities, market conditions and risk capacity is the main essence for choosing the right leverage level.

- Determine your trading objectives. Ask yourself the following questions:

How much profit do you plan to make?

How long do you plan to hold your positions?

What trading strategies are you going to use?

Defining your goals will help you understand what level of leverage will be most appropriate for your needs. - Assess the level of risk you are willing to accept. Think about the following:

How much of your capital are you willing to lose in a single trade?

How comfortable are you with high levels of risk?

What are your previous trading results and how confident are you in your strategies?

The higher the leverage, the higher the potential profit, but also the higher the risk of loss. Beginning traders are advised to start with lower leverage. - Start with low leverage

If you are just starting to trade with leverage, start with a small level, such as 1:10 or 1:20. This will help you better understand how leverage works and reduce the risks of significant losses - Use risk calculators

Use online risk calculators to calculate the optimal leverage for your trades. These tools can help you determine how changing leverage affects your profit and loss potential and help you choose the most appropriate level - Increase leverage gradually

As you gain experience and confidence in your trading strategies, you can gradually increase your leverage. This will allow you to adapt to higher levels of risk and better manage your positions - Review and adjust your leverage level regularly

Markets are constantly changing and your strategy should also be flexible. Regularly review your leverage level depending on current market conditions and your trading performance. Be prepared to adjust it according to market changes and your personal goals

Examples of choosing leverage:

Conservative trader:

Goals: Stable capital growth with minimal risks

Risk level: Low

Leverage: 1:10 or 1:20

Moderate trader:

Goals: Balance between risk and return

Risk level: Medium

Leverage: 1:50

Aggressive Trader:

Goals: Maximize profits with a willingness to accept high risks

Risk level: High

Leverage: 1:100 or higher

Trading CFD involves risks

Try Exness leverageFrequently Asked Questions (FAQ)

What is leverage in Exness?

In simple words, Exness leverage is like a loan (but the trader doesn’t owe anything) to a trader that allows to increase trading opportunities with only a part of the required amount in the account.

How to change leverage in Exness?

To change the leverage Exness, log in to your account, select the desired account and set the desired leverage in the settings section. The process is simple and intuitive.

What is the maximum leverage Exness offers?

Exness offers different levels of leverage depending on the account type and instrument, up to 1:2000. This is one of the highest leverage levels in the industry, making Exness attractive to experienced traders.

How to use leverage at Exness?

Use leverage to maximize your trading opportunities, but be sure to manage your risk and follow your strategy. Start with small position sizes, use stop losses and constantly monitor the market.

Trading CFD involves risks

Start Exness leverage trading