Change Exness Leverage Size

Trading CFD involves risks

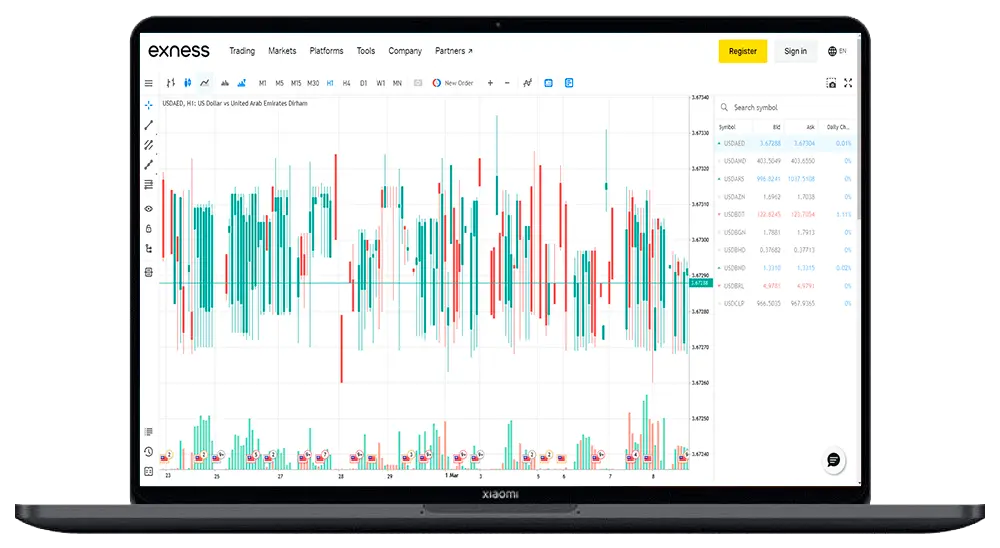

Change Leverage ExnessExness trading enables you to adjust your leverage and you need to work out how to do this. In this article you will learn how easy it is to change the Exness leverage size

Article updated:

23.05.2024Why Change Leverage?

Exness Leverage is a tool used by traders to increase their potential, even with a fraction of the amount needed.

Usually, the use of leverage is justified by different strategies or trading plan in case of favorable situations, so for example:

Changing market conditions

This is when the market becomes highly volatile, and in such situations traders reduce the amount of leverage.

Applying a new trading strategy

The use of different strategies implies different levels of leverage, e.g. for scalping it is standard to use high leverage, and in cases of long-term investments use lower leverage.

Risk management

When using large amounts of capital, you should choose leverage levels carefully to reduce potential risks

Instructions on how to changing the leverage in EXness

You can modify leverage in Exness through the Personal Area (PA). An example of where you can change leverage on an critical trading account in a simple way is shown below.

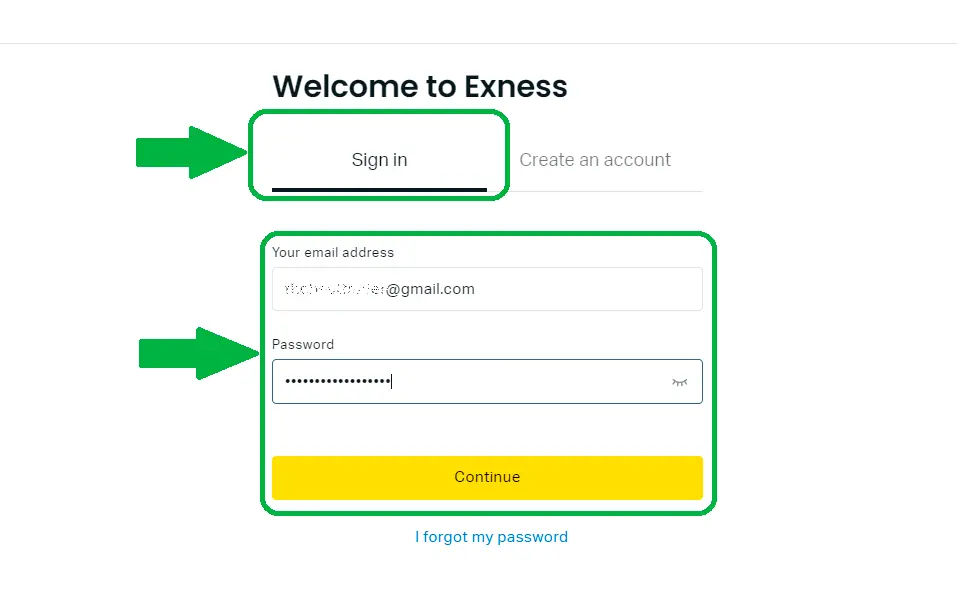

In order to proceed with changing the leverage, you need to log in to the Exness PA (you can read the Exness login instructions) or click below to log in (use your credentials to access your trading account settings).

Trading CFD involves risks

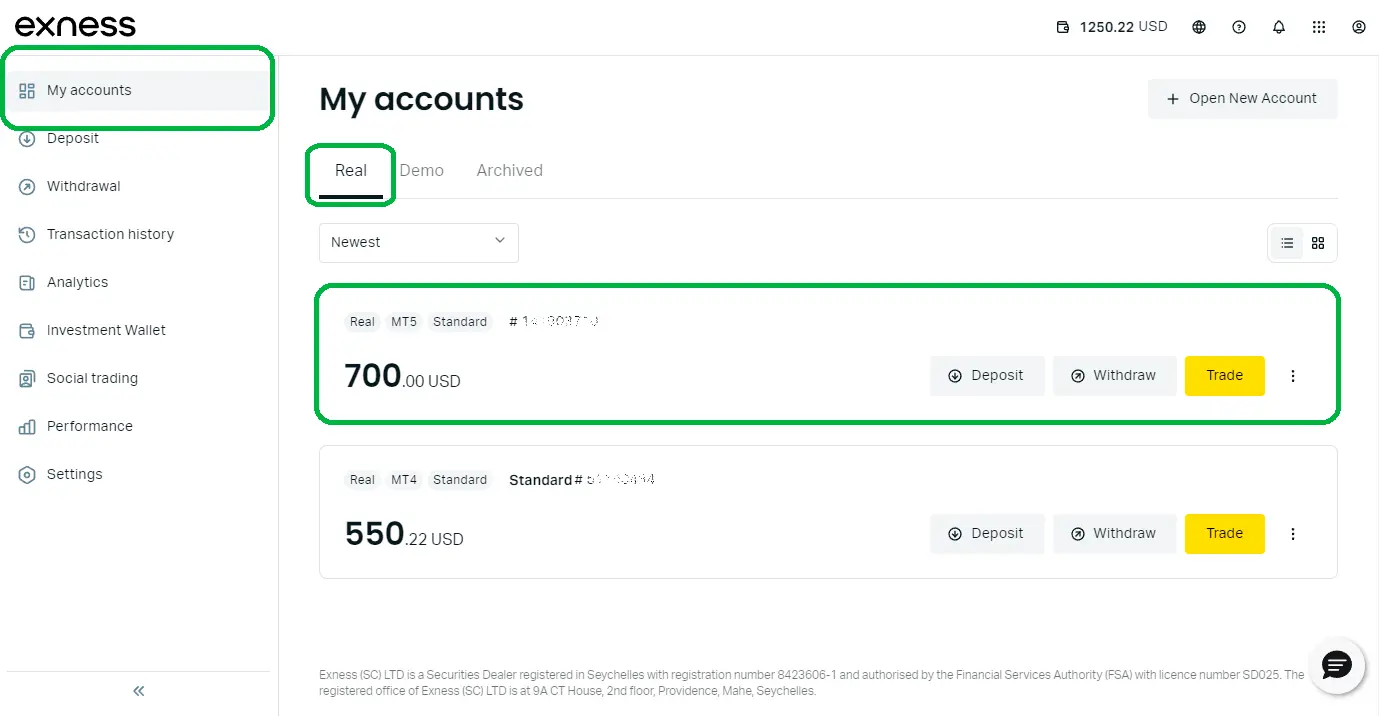

Login in Exness PASelect the trading account you are interested in and you need to change the leverage on it, this should be done on the main page of your PA, in the tab where all your accounts are displayed.

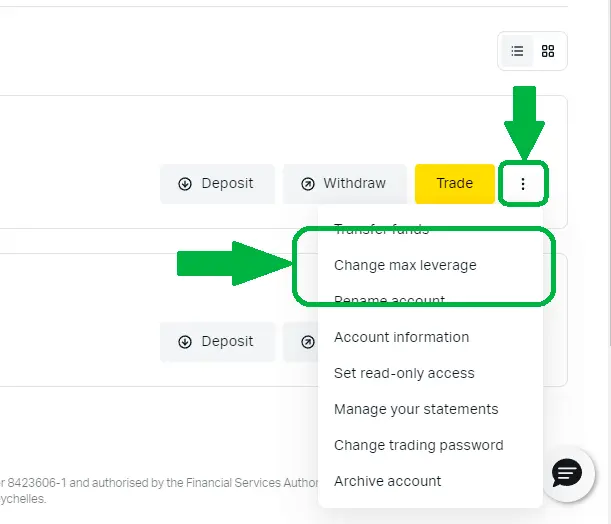

Repeat as on the image, you need to find the settings button (in our case it is an icon with three dots) it is located next to the selected account and in the opened menu you will need to find the item “Change maximum leverage“.

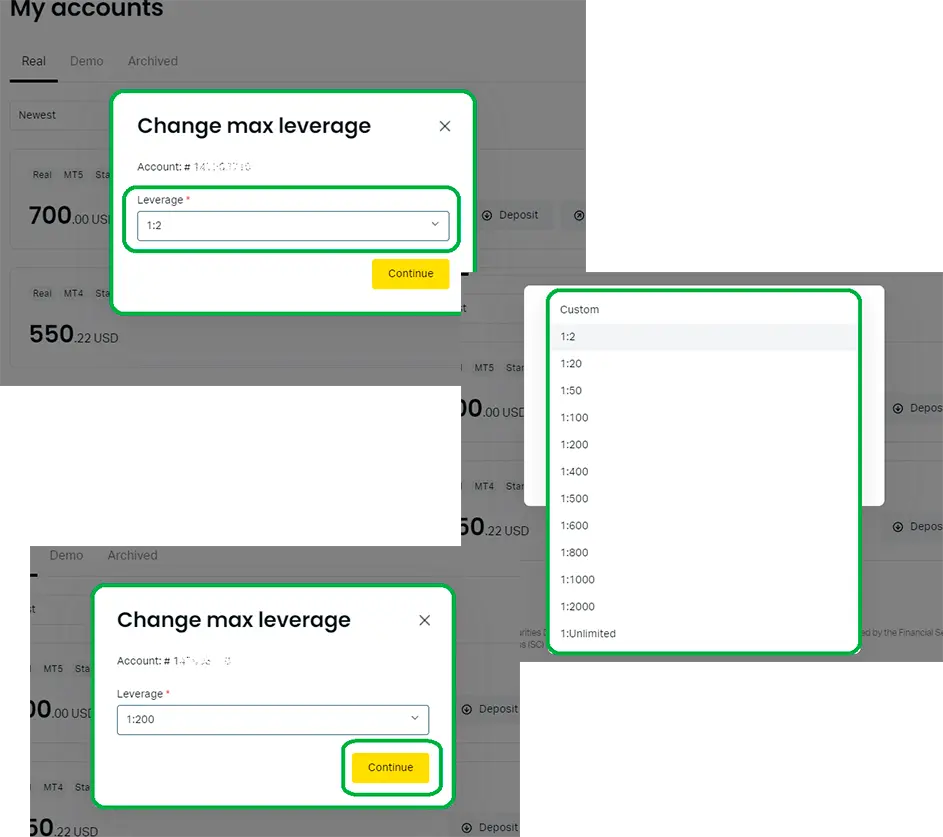

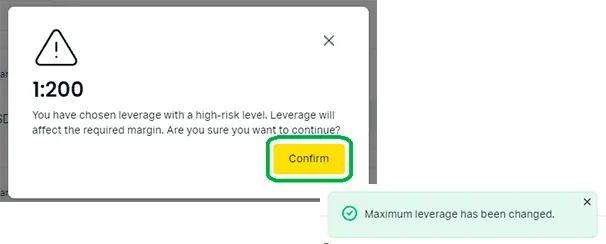

A window will open where you can select the desired level of leverage (the size can be 1:2 to 1:unlimited). Make sure that the level you want to set will correspond to the level of risk you are willing to take. All you have to do is click on the continue button.

The only final step left is to read the warning and accept the new leverage size for the selected trading account.

Please note that the new leverage does not apply to previously opened trades and will only work with new positions.

Trading CFD involves risks

Change Exness LeverageLeverage can be changed on any type of trading account except for Muslim (Islamic) accounts.

Leverage Limitations and Rules at Exness

Exness offers various amounts of leverage but with certain rules:

Maximum leverage that can be set:

Up to 1:2000 for MetaTrader 5

Up to 1:unlimited for MetaTrader 4

Please see the terms and terms of Exness Unlimited Leverage.

Margin Requirements

In order to apply leverage, there is another rule, and it has to do with the Exness margin requirement. Margin requirement will vary with the level of leverage, so the higher the leverage, the further down the margin calls are.

The formula for calculating margin:

Margin = Lots x Contract Size / Leverage

Example:

Lots: 5

Contract size: 100000 dollars

Leverage: 1:1000

Margin = 5 x 100,000 / 1000 = 500 dollars

Trading CFD involves risks

Exness leverage changeTrading strategy with frequent leverage changes

One of the trading strategies that involves frequent changes in leverage is trading on the news. This strategy is based on the use of economic news for trading operations. The strategy is popular because it potentially brings a lot of profit as economic news causes significant movements in the market.

When leverage is increased:

Before the release of important news, traders can increase leverage to take advantage of the expected significant market movements. This maximizes the potential profits from news spikes.

Example:

If the US employment report is expected, a trader may increase leverage to 1:200 or higher to maximize potential profits from the expected movement.

After News Releases

When to reduce leverage:

After the news is released, when the market begins to stabilize, traders may reduce leverage to minimize risk. This is especially important if the market is not moving in the predicted direction.

Example:

If a report is less significant than expected and the market begins to correct, a trader may reduce leverage to 1:50 or 1:100 to limit potential losses.

Tips that can help to achieve success for trading the news

- Study the economic calendar to understand the release dates of important news and be ready to trade

- This strategy involves a lot of risk and therefore you need to protect yourself to limit losses (use different tools)

- Quickly changing your strategy is the main point as the strategy is directly dependent on market reactions to the news

- Using small volumes to start with is a sensible approach

Trading CFD involves risks

Try Change Leverage Exness strategyFrequently Asked Questions (FAQ)

What are the leverage sizes available in Exness?

Leverage sizes at Exness start from 1:2 and up to 1:2000, depending on the type of trading account. If certain conditions are met, you can get leverage of 1:unlimited.

What is the ideal leverage level for first-time traders?

It is suggested that first-time traders start with a small leverage, such as 1:10 or 1:20, and then gradually increase it to 1:50 or 1:100 to better manage risk and to gain time to gradually gain experience.

How often can I change the leverage size of Exness?

You can change the leverage amount in Exness at any time that suits you through the Exness PA in your trading account settings.

Does leverage have an influence on margin calls?

There is a reciprocal correlation between leverage and margin needs. The higher the leverage, the lower the margin required to execute a trade.