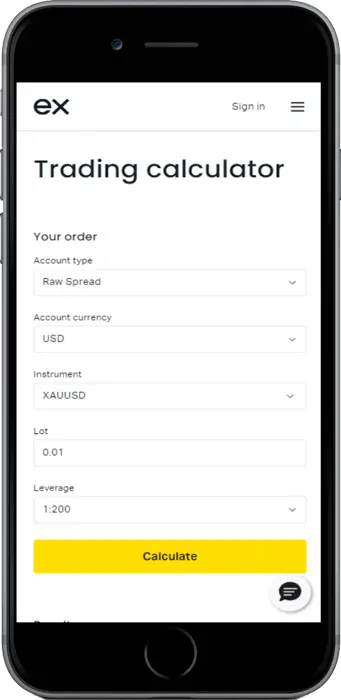

The trading calculator helps estimate the conditions of a trade by considering details like account type, currency, trading instrument, volume in lots, and leverage. It uses almost real-time data to calculate things like margin, commission, swaps, and pip value.

Exness trading calculator

There are important definitions when you are using an Exness calculator.

Account type: Exness calculator works for Standart, Raw spread, Zero, Pro and Standard Cent accounts, The calculations based on each account will be different.

Account currency: Your account currency will be the base currency that you have for deposit and withdrawal and proceed the calculations for trading and investment.

Instrument: The instrument menu in calculator is about currency pairs for Forex and also pairs for cryptocurrencies ( examples respectively: XAU-USD and BTC-JPY)

Leverage: In trading, leverage allows you to control a larger position with a smaller amount of money. It’s like borrowing money from your broker to increase your trading power. For example, if you have leverage of 1:200, it means for every $1 you have in your account, you can trade $200. Let’s say you have $1,000 in your trading account: With 1:200 leverage, you can control a position worth $200,000. This can amplify your profits if the trade goes your way, but it also increases your risk because losses can be magnified as well. So, while leverage can boost your potential gains, it can also lead to larger losses.

Exness has many different options to give leverage such as 1:2 to 1:2000 to unlimited. In the Exness trading calculator, all the possible leverage options can be selected for further calculations.

Lot: In trading, a “lot” is a standard unit of measurement for the size of a trade. It represents how much of a financial asset you are buying or selling. For example, in forex trading: 1 standard lot is equal to 100,000 units of the base currency. 1 mini lot is 10,000 units. 1 micro lot is 1,000 units. So, if you’re trading EUR/USD and buy 1 standard lot, you’re buying 100,000 euros worth of U.S. dollars.

Trading CFD involves risks

Try Exness calculatorHow to use Exness trading calculator

Choose your Exness account type, then set your account’s leverage and currency.

-Pick the trading instrument you want from the list provided.

Decide on the size of your trade in lots, then click the ‘Calculate‘ button to see the results.

Why should you use the Exness trading calculator?

You can use the Exness trading calculator because it helps your trading plan by giving you estimation of your profits and losses. With features like better-than-market conditions, top-notch security, accepted worldwide and a focus on transparency, it makes trading easier and more reliable. Plus, Exness is known for excellent customer service, so you can trust the results.

Trading CFD involves risks

Exness Trading calculatorThings to avoid using Exness calculator

- Entering the wrong lot size: If you put in the wrong number, your calculations for margin, profit, and loss can be different and misleading.

- Incorrect leverage: Using the wrong leverage value can lead to unexpected results in how much you can control and your potential risk.

- Forgetting currency differences: Not adjusting for your account currency can cause errors in calculating pip values or margin.

- Ignoring fees and swaps: If you don’t include possible fees or swaps, your profit/loss estimates will not be accurate.

- Overestimating potential gains: Calculators give estimates, not guarantees, so it’s important not to rely on them too much without considering market changes. (avoid daydreaming about high expectations)

Frequently Asked Questions (FAQ)

What is a pip value

A pip (short for “percentage in point”) is a standard unit of measurement for the smallest price movement in a currency pair in forex trading. Typically, a pip is the fourth decimal place in most currency pairs. Pip value is the amount of money you gain or lose when the price moves by one pip.

What is a margin?

Margin in trading is the amount of money you need to deposit with your broker to open and maintain a trade. It’s like a security deposit that shows you have enough funds to cover potential losses.