Islamic forex account in Exness

Trading CFD involves risks

Open Islamic AccountMany Shariah-compliant traders want to try their hand at trading. In order to choose the right conditions from a large number of offers – study the terms and conditions and rules.

Article created:

25.06.2024What a Muslim Account Is For

A Moslem account is especially meant for traders who abide by the principles of Sharia law. Islam prohibits any type of financial dealing with interest, which therefore makes normal trading accounts unsuitable for such traders. This need has led to the creation of Islamic accounts that do without charging interest and implicit duties, which is in accordance with Shariah law.

Muslim scholars’ opinion on Islamic account trading

Mufti Faraz believes that it is possible to trade on an Islamic account, provided that the company that offers the Islamic account has a Shariah advisor. Any actions related to leverage should not be used unless there is a consultation with a Muslim advisor who can properly explain correctly.

And some other scholars believe that forex trading can be harmful if trades have a positive swap. In order for trading to be approved in Islam, one should use a broker that offers swap-free accounts.

Islamic accounts are designed in such a way that they comply with the principles and norms of Shariah. Riba is forbidden in Islamic finance, and financial transactions must be honest and transparent (so that both parties have the same costs and profits), as well as the trader must not have high risk and must not speculate.

Trading CFD involves risks

Exness Muslim AccountMoslem account on Exness

Exness, as well as many major brokerages, has an Islamic account. To see if it meets your liking, study the rules and special features of the trading account, and if you like it, find out how to get it opened:

Exness rules for an Islamic account

Exness allows you to open an Islamic account for Moslem traders who would like to trade without infringing on the rules of Shariah:

No crossing money (commission) for carrying over positions to the next day is the main condition that applies to an Islamic account so that there is no riba on it.

Trading CFD involves risks

Exness Islamic AccountExness Muslim Account Requirements

Using a specialized account requires compliance. Learn the main ones in order not to violate the rules:

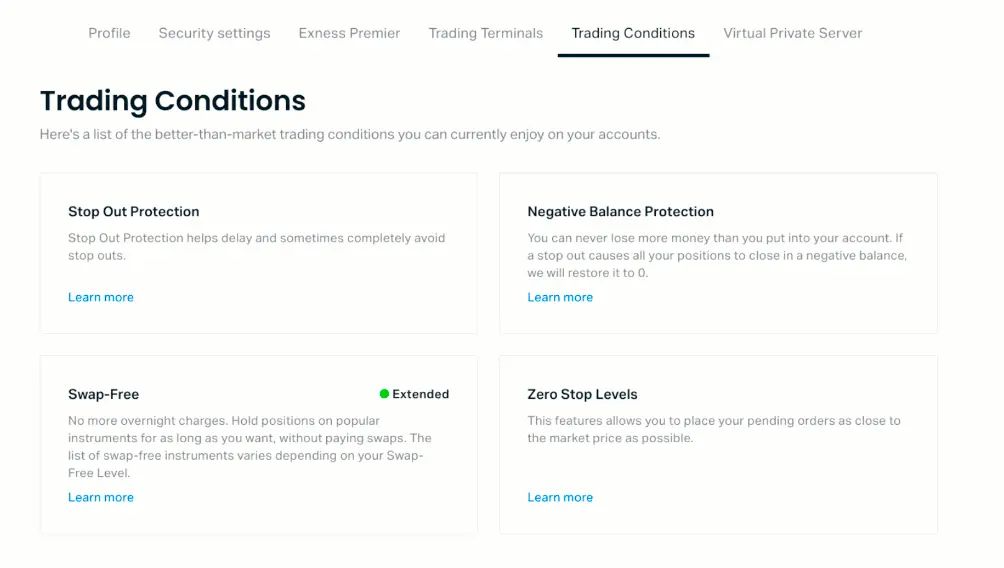

- Exness accounts registered in Islamic countries – no swaps rule is automatically applied (you can see if this status is available in the settings – trading conditions).

- If you are a Muslim but not from an Islamic country – you will need to write to support in order to get the Islamic status of your trading account.

- When connecting an Islamic account, carefully read all the terms and conditions offered by Exness – it specifies what fixed fee the broker charges for a position.

- Some trading accounts may be commission-free – it will be specified in the trading account rules.

Some assets will not be available for use on such an account. Their use may violate the rules and regulations of Shariah.

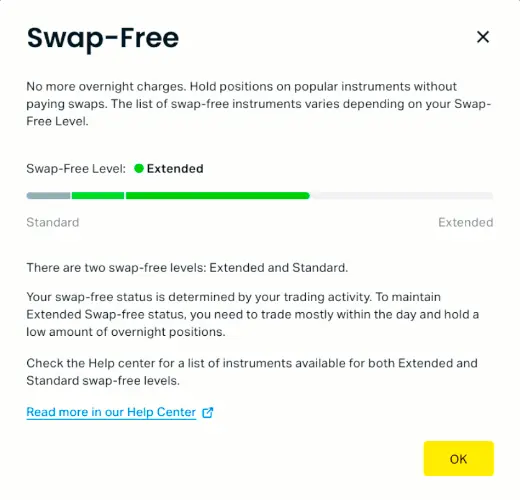

If you have received Swap-free status on your Exness account, it applies to all types of trading accounts and all newly opened accounts will have this status. Do not abuse this status as you may lose it and it will be more difficult to get it again.

Exness reserves the right to revoke the status of an Islamic account if the terms and conditions are abused. This right applies to traders who fraudulently attempt to use an Islamic account but do not adhere to the rules and regulations of Shariah. You will be notified in your Exness account when the status is canceled!

Obtaining an Islamic account with Exness

Opening an Islamic account with Exness can be done in two ways:

If you live in an Islamic country

If you live in an Islamic country, you can register with Exness and you will have the status of “No Swap” account. You can see the status in the settings in the “trading conditions” tab.

If you do not reside in an Islamic country or have not received an Islamic account

If you have registered or would like to register for Exness and get swap-free status (status for Islamic account), then follow the further instructions:

Once you have registered and confirmed your Exness account, you will need to communicate with the Exness Helpdesk and let them know that you wanted to change to an Islamic account so as not to violate Shariah law. You can do this either via live chat or via the email you used to register your Exness account.

Trading CFD involves risks

Try Islamic AccountYou will have to wait for a response from customer service that they have accepted your request.

If you contacted Exness via Email, you may receive a response the next day.

Confirmation: After confirmation – make sure your account has been updated. Go to the finder and look at the terms and conditions.

Assets available for Islamic account

After applying the new account settings, you will be able to use it to trade just as you did on your old account:

Forex

GBP/USD (Pound Sterling to US Dollar), EUR/USD (Euro to US Dollar)

Metals

Gold (XAU) and Silver (XAG)

Indices and stocks

NVDA (Nvidia), DE30

Advantages of an Islamic account

The main advantages of an Islamic account for Muslim traders:

- Shariah compliant – Islamic account has no swaps or interest.

- Trading conditions are described in detail for transparency of transactions.

- Choice of a large number of assets (except for those that may violate Shariah).

- Service and support for traders is of the same quality as on a standard account.

Use an Islamic account for authorized trading with Exness. If you are in doubt about the correct understanding of an Islamic account, contact your spiritual advisor who can answer questions related to Islamic finance.

Trading CFD involves risks

Exness Islamic tradingFrequently asked questions about Islamic account with Exness

Does the Islamic Exness have any latent fees?

Muslim (no swaps) account do not have additional secret commissions. Exness grants this account to make it comfortable for traders. All trading conditions are described in Exness documentation.

How long does it take to open an Islamic account?

Opening an Islamic account can take several days. Exness has to verify the documents and transfer the account to an account with a swap-free rule. You will receive an email notification of the outcome of Exness’ decision.

Do I need to pay extra to switch to an Islamic account?

Exness does not require any fees to switch to an Islamic account. The only fee that appears on the Islamic account is the transaction opening fee. The price for opening a transaction is minimal and is stated in the rules.

When can I get an Islamic account?

For those in Islamic nations, an Islamic account is created automatically. You can also switch to an Islamic account once you have joined (if you do that you do not have an auto-enrolled Islamic account).