Rules and Limitations of Leverage on Exness

Trading CFD involves risks

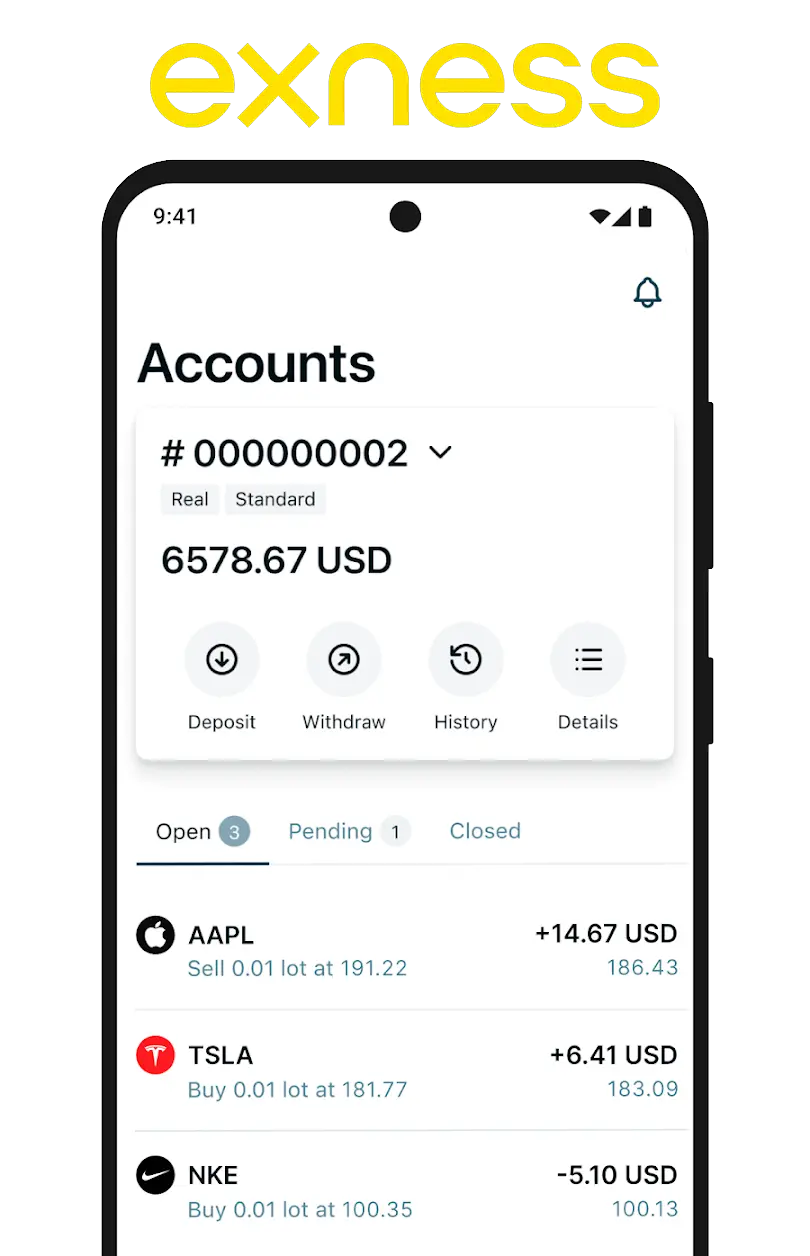

Exness Leverage rulesLeveraged trading on the Exness platform opens up a wide range of opportunities for traders, but requires knowledge and compliance with certain rules and restrictions. In this article, we will take a closer look at all aspects of leverage on Exness so that you can trade safely and effectively.

Article updated:

28.05.2024Need to know the rules of leverage

Exness is a popular financial trading platform that provides traders with a wide range of tools and resources to help them succeed in the financial markets. One of the key features of the Exness platform is the leverage option, which allows traders to increase their exposure to the markets with a smaller initial investment. However, it is important to understand the leverage rules and regulations set forth by Exness, as leverage can also increase potential losses.

Leverage rules and regulations

Exness allows you to use different levels of leverage, which depends on the type of trading account and can range from 1:2 and up to 1:2000. However, under certain conditions, the amount of leverage in Exness can even be unlimited.

Some instruments, such as cryptocurrencies and exotic currency pairs, may have lower leverage levels due to their high volatility. For example, for cryptocurrencies, the maximum leverage may be limited to 1:100.

Exness tries to adapt leverage levels during times of high fluctuations and market volatility during important economic events. The reason for this is in an effort to protect traders from large risks during times of high market uncertainty, for example

- Before important economic events, leverage may be reduced for a period of time in order to reduce potential losses.

- During times of high volatility, Exness may reduce the available leverage so that traders are protected from sharp and negative market movements.

Restrictions and regulations that the broker complies with

Regulatory requirements can have a significant impact on the use of leverage. Different countries and regions have different regulations that brokers such as Exness are required to comply with.

- In some countries, regulators may limit the maximum amount of leverage and therefore traders will not be able to set a higher amount than suggested.

- Transparency in providing information about the possible risks associated with leverage and traders should understand the possible consequences.

- Strict margin requirements are set so that traders are not exposed to excessive risks and the broker has the right to close the trader’s positions to prevent further losses

- A trader cannot lose more capital than he has invested in the investment

Exness is committed to complying with all local and international regulations, providing traders with a safe and secure trading environment.

Trading CFD involves risks

Read more about exness leverageConclusion about leverage rules

It is important that every trader understands and complies with Exness’ leverage rules and regulations, as well as being fully aware of the possible risks that come with leverage.

Knowing, understanding and complying with the Exness leverage rules is an important part of ensuring responsible trading. Knowing the maximum leverage levels, adapting quickly to changing conditions and following the rules will help you better manage the risks involved and achieve success in the forex market.

Frequently Asked Questions (FAQ)

If the Exness leverage rules are not clear?

If you have any questions or difficulties in understanding the rules and limitations of Exness Leverage, you can always contact our support team with your questions.

How do regulations affect the use of leverage?

Regulations may limit maximum leverage levels to protect traders from excessive risks. Exness complies with all local and international regulations.

Why is it important to know the leverage rules?

Knowing the leverage rules helps traders effectively manage risk and trade more safely.